Project Overview

The Cross Chain AI Yield and Risk Optimiser is an advanced DeFi platform that leverages artificial intelligence to identify optimal yield opportunities across multiple blockchains while actively managing risk. The system continuously analyzes protocol health, market conditions, and historical data to maximize returns within user-defined risk parameters.

This project represents the intersection of AI and DeFi, bringing institutional-grade portfolio management to decentralized finance.

The Challenge

DeFi yield optimization faces several complex challenges:

- Information Overload: Thousands of yield opportunities across dozens of chains

- Risk Assessment: Evaluating smart contract risk, liquidity risk, and market risk

- Cross-Chain Complexity: Managing positions across different ecosystems

- Market Dynamics: Yields change rapidly, requiring constant rebalancing

- Gas Optimization: Minimizing transaction costs while maximizing returns

Technical Architecture

AI/ML Engine

The core intelligence is powered by machine learning models:

Risk Assessment Model:

- Protocol health scoring based on TVL, audit status, and team reputation

- Smart contract risk analysis using historical exploit data

- Liquidity depth analysis for exit risk assessment

- Volatility prediction for underlying assets

Yield Prediction Model:

- Historical yield analysis across protocols

- Market sentiment integration

- Token emission schedule impact

- Fee structure optimization

Portfolio Optimization:

- Modern Portfolio Theory adapted for DeFi

- Risk-adjusted return maximization

- Correlation analysis across yield sources

- Rebalancing threshold optimization

Our AI models are trained on historical DeFi data spanning multiple market cycles, including major exploits and market crashes, ensuring robust risk assessment.

Cross-Chain Infrastructure

The platform operates across multiple ecosystems:

Supported Chains:

| Chain | Protocols | Strategy Types |

|---|---|---|

| Solana | Marinade, Raydium, Orca | Liquid Staking, LP, Lending |

| Ethereum | Aave, Compound, Lido | Lending, Liquid Staking |

| Avalanche | Trader Joe, Benqi | LP, Lending |

| Polygon | QuickSwap, Aave | LP, Lending |

| Arbitrum | GMX, Radiant | Perp LP, Lending |

Smart Contract Layer

Vault Contracts:

- User deposit management

- Strategy execution

- Automated compounding

- Emergency withdrawal mechanisms

Strategy Contracts:

- Protocol-specific integrations

- Position management

- Reward harvesting

- Gas-optimized transactions

Key Features

Intelligent Yield Discovery

The system continuously scans DeFi protocols to identify:

- High-Yield Opportunities: APY above market average

- Risk-Adjusted Returns: Best returns within risk tolerance

- New Protocol Detection: Early access to emerging opportunities

- Yield Decay Prediction: Exit before returns diminish

Dynamic Risk Management

Real-Time Monitoring:

- Protocol TVL tracking

- Smart contract activity analysis

- Oracle price feed validation

- Liquidation risk assessment

Automated Risk Response:

- Position reduction on risk increase

- Emergency exit triggers

- Diversification enforcement

- Impermanent loss mitigation

Portfolio Strategies

Users can choose from predefined strategies or customize their own:

| Strategy | Risk Level | Target APY | Chains |

|---|---|---|---|

| Conservative | Low | 5-10% | ETH, SOL |

| Balanced | Medium | 10-20% | Multi-chain |

| Aggressive | High | 20%+ | All supported |

| Stablecoin | Very Low | 3-8% | ETH, SOL |

Cross-Chain Execution

Bridge Integration:

- Automated cross-chain transfers

- Optimal bridge selection

- Fee estimation and comparison

- Transaction tracking

Gas Optimization:

- Batch transaction grouping

- Optimal execution timing

- Priority fee management

- Failed transaction handling

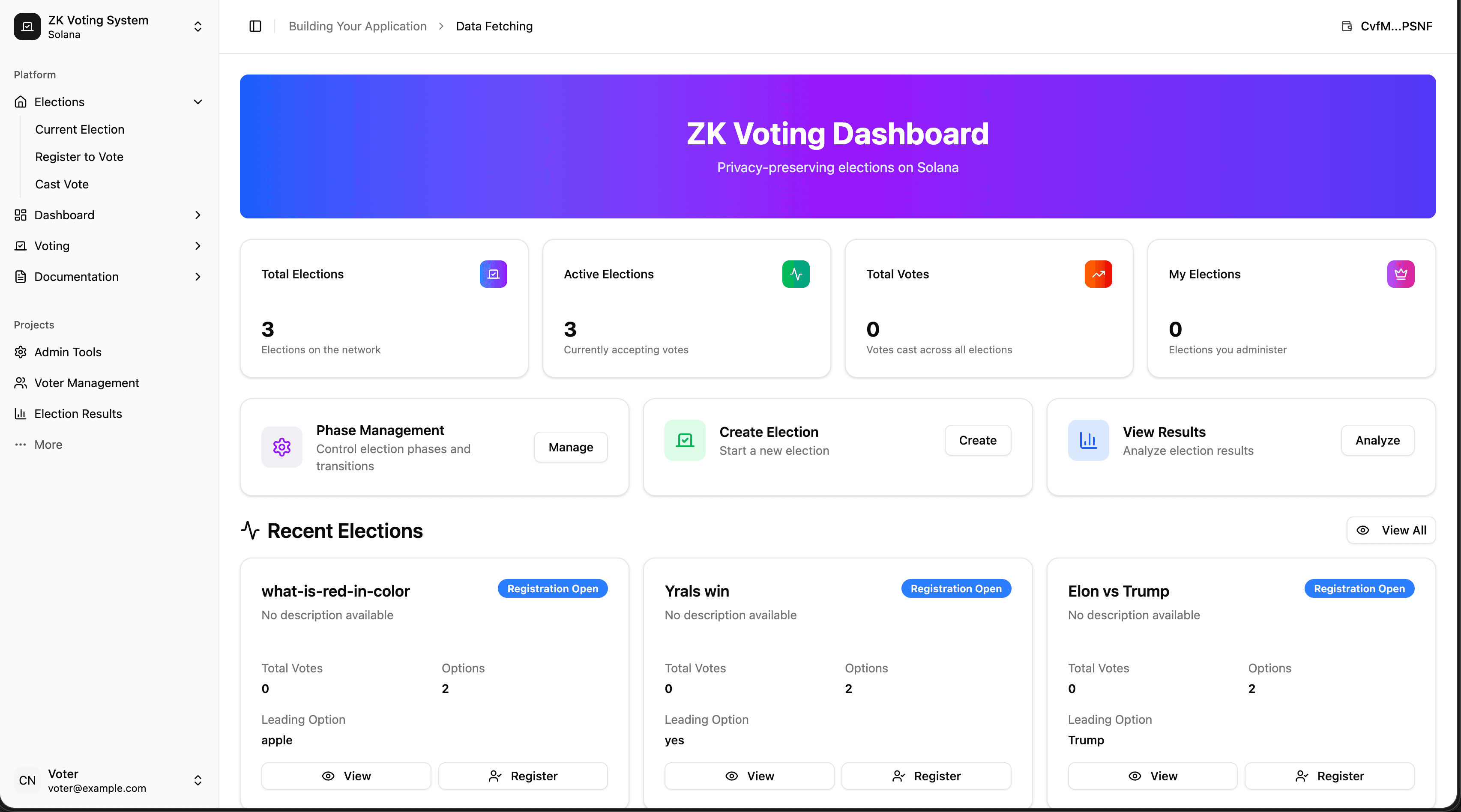

Frontend Application

The Next.js dashboard provides complete portfolio visibility:

Dashboard Features:

- Real-time portfolio value tracking

- Position breakdown by chain and protocol

- Historical performance charts

- Risk metrics visualization

- Pending transactions status

Strategy Management:

- Risk tolerance configuration

- Chain preferences

- Protocol whitelisting/blacklisting

- Rebalancing frequency settings

Security Measures

Security is paramount in DeFi optimization:

- Audited Contracts: All vault and strategy contracts audited

- Timelock: Admin actions subject to delay

- Emergency Pause: Instant position freezing capability

- Gradual Deployment: Phased rollout with TVL caps

- Insurance Integration: Coverage options for smart contract risk

AI Model Governance

Transparency in AI decision-making:

- Explainable Recommendations: Clear reasoning for each suggestion

- Performance Tracking: Historical accuracy of predictions

- Model Updates: Regular retraining with new data

- Human Override: Users can reject AI recommendations

Results & Impact

The Cross Chain AI Yield Optimiser demonstrates the potential of AI in DeFi:

- Risk-Adjusted Returns: Outperforms manual management

- Time Savings: Automated monitoring and rebalancing

- Diversification: Intelligent spread across chains and protocols

- Education: Helps users understand DeFi risk factors

This platform showcases our ability to combine cutting-edge AI/ML with blockchain technology, creating sophisticated financial tools accessible to all DeFi participants.

By combining artificial intelligence with cross-chain DeFi, we're building the future of automated, intelligent portfolio management for the decentralized economy.